Four dTAO futures: Exploring the potential market scenarios

dTAO has landed. Yet its ongoing impact remains up in the air. So what are the different future scenarios that dTAO could lead to? Here are four potential states, and what they’d mean for Bittensor...

Of all the questions asked in the lead-up to dTAO, at heart they’re mostly asking the same thing: how will it affect the Bittensor ecosystem?

Free market forces are inherently fluid. Even the most experienced economists struggle to anticipate the shifts and shocks. dTAO introduces a powerful mechanism for unleashing the energy of competitive capitalism between the subnets themselves, replacing an oligarchic emission function with a transparent market-driven signal. It’s exciting, and the potential for explosive investment and innovation is huge.

Exposing subnets to the volatility of the market should, in theory, push greater investment and growth. But it’s more complicated than that. Markets aren’t just about supply, demand, and prices. They’re complex adaptive systems, where the interplay between diverse actors, incentives, and needs creates unexpected consequences.

And because it’s an interdependent system, these consequences can lead to scenarios that solidify, perpetuating themselves in an ongoing self-fulfilling state. These states can be modelled as future scenarios - and understanding how they might come about can help us to anticipate, plan, and navigate them should they arise.

If you’re new to Bittensor, you might prefer to start with our dTAO staking primer, or our dTAO FAQs. And - as always - this is not investment advice. Otherwise, read on, and discover the exotic economic landscapes towards which dTAO could drive us…

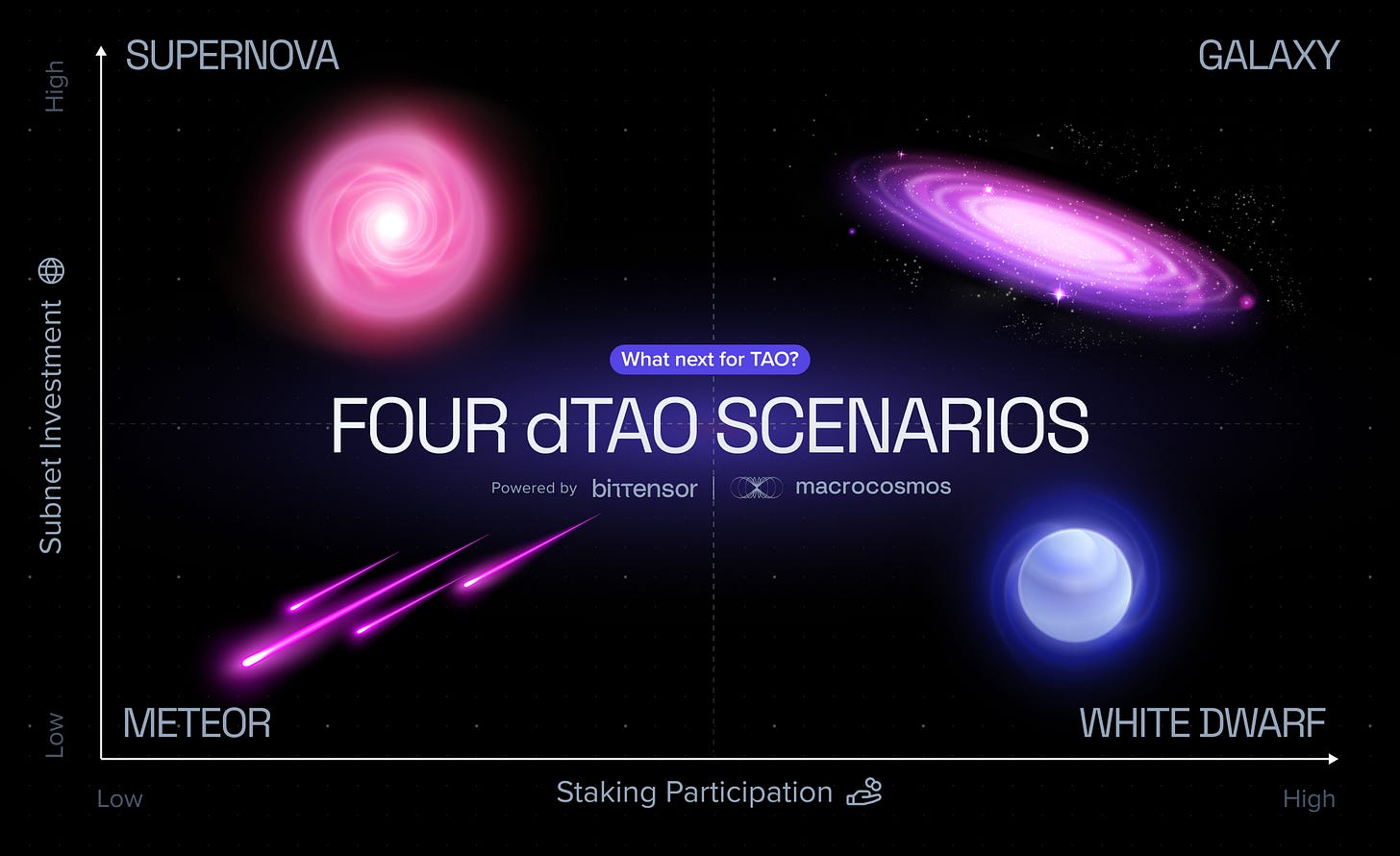

Enter the matrix

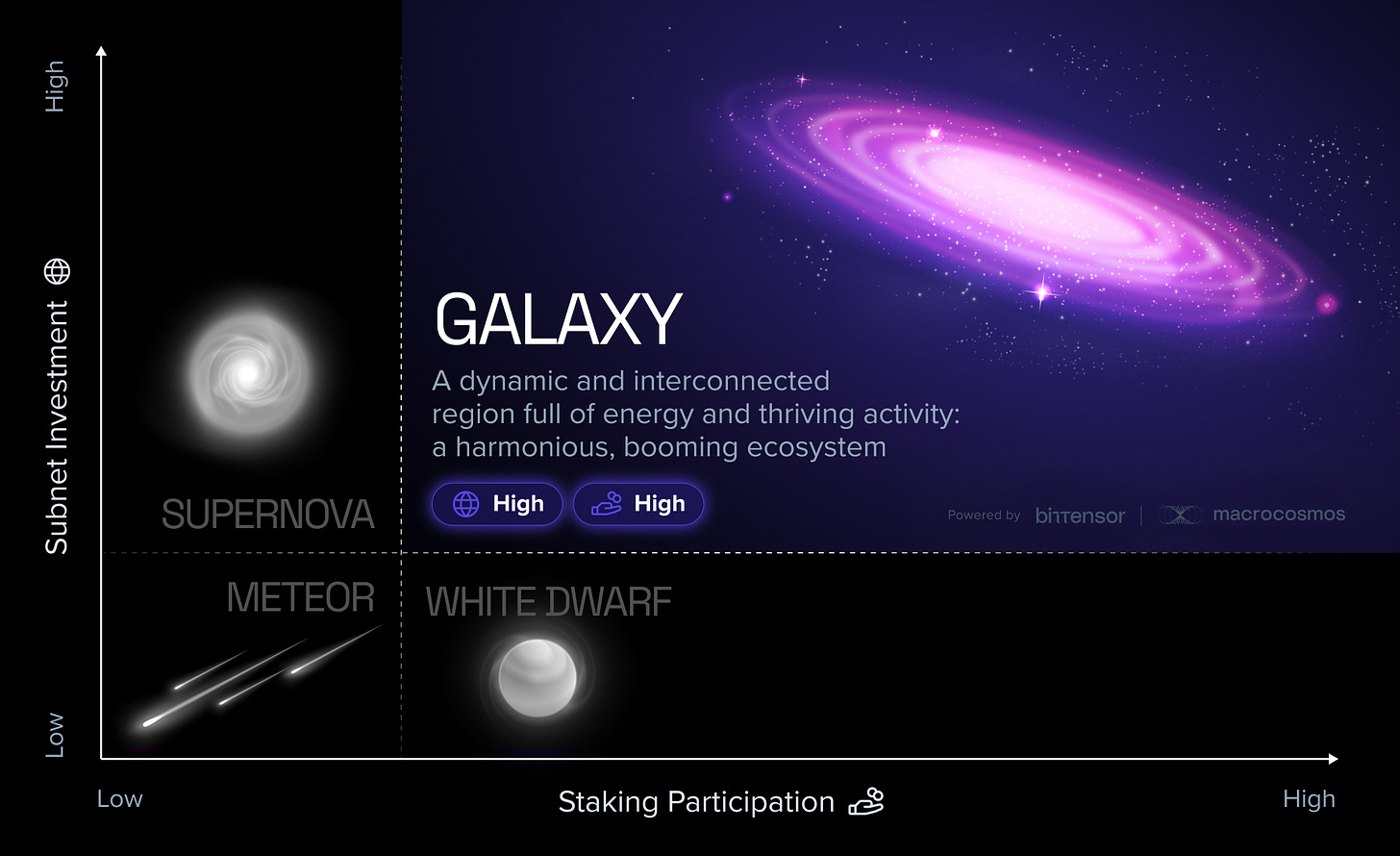

We’ve plotted four scenarios based on a quadrant matrix, where:

The X‐axis measures Staking Participation (from Low ⚠️on the left to High ✅on the right),

The Y‐axis measures Subnet Growth (from Low ⚠️at the bottom to High ✅at the top).

Each scenario describes the state of the network after dTAO activation, focusing on how participants (subnet owners, TAO holders, miners/validators) behave—and how the dTAO mechanism responds.

Staking participation explores the extent to which TAO holders stake their tokens, either on Root Network or on specific subnets. The proportion of staked to unstaked TAO - and especially the proportion of TAO staked to Root versus TAO staked to subnets for Alpha - has a significant impact on the state of the ecosystem.

Subnet growth measures the investment within subnets themselves: the rate at which they grow their teams, release new products, and deliver value.

By exploring the relationship between staking participation and subnet growth, we can better understand the optimal conditions for the ecosystem, and the interdependence between them.

Through analysis of how Staking Participation (low ↔ high) and Subnet Growth (low ↔ high) may evolve post‐dTAO, we get four distinct trajectories. Each scenario highlights different incentives, liquidity conditions, and strategic concerns for key actors:

Subnet Owners: Are they motivated to build if user adoption is high or if yields overshadow actual usage?

TAO Holders: Do they stake more or remain liquid, and how do they respond to price and network signals?

Miners/Validators: Are they sufficiently rewarded and secure, or does volatility or low adoption undermine their incentive?

So what are the different states that dTAO could engender in the Bittensor ecosystem?

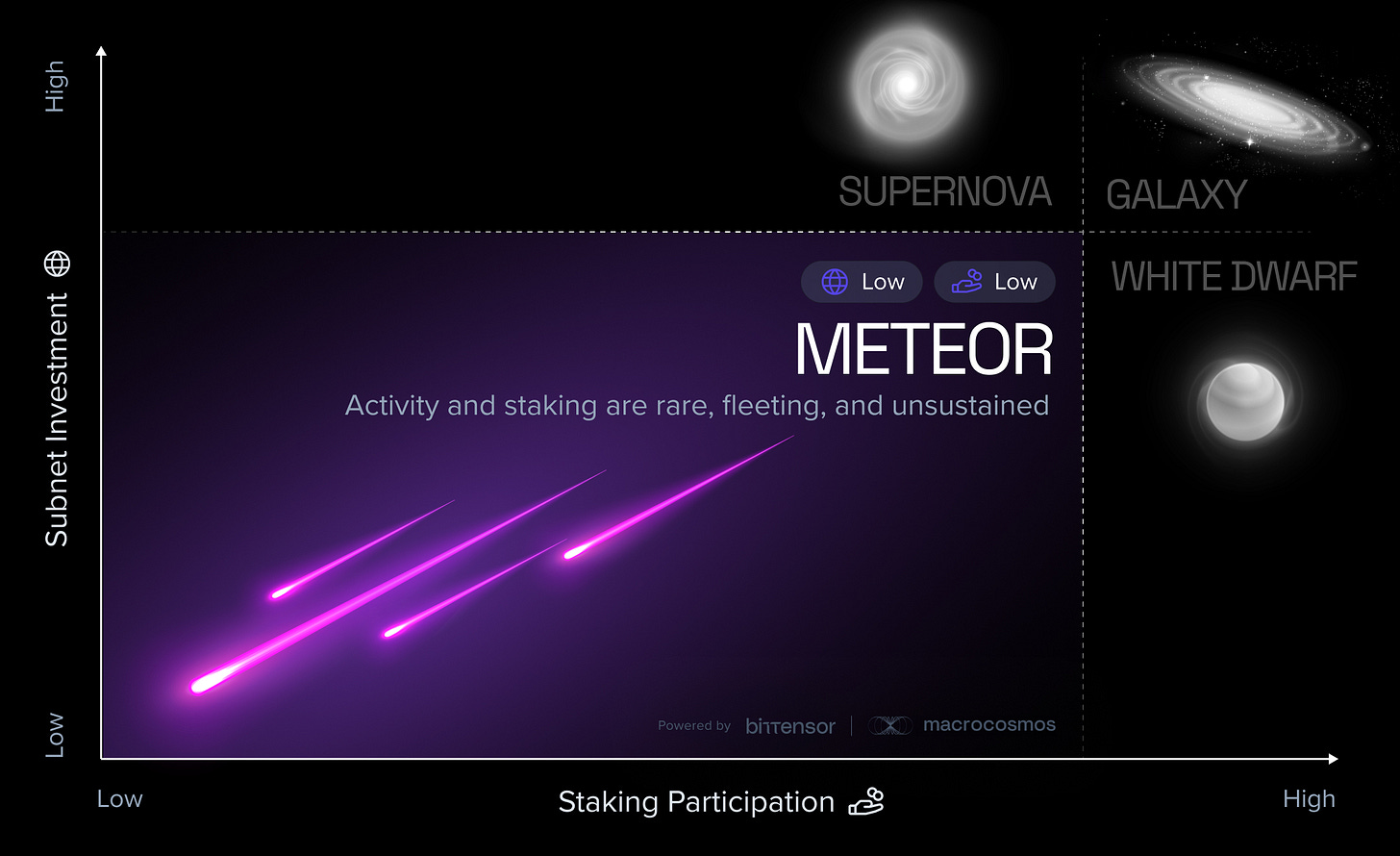

1. Meteor [Low Staking – Low Subnet Growth]

Subnet activity and staking are both rare, fleeting, and not sustained, reflecting weak incentives and shallow engagement.

It’s not the absolute worst-case scenario, but it’s close: what happens if both staking activity and subnet investment stay low? And how might the market react?

The ‘Meteor’ state happens when…

Minimal staking participation: Only a small portion of TAO’s circulating supply is locked into staking or liquidity pools - corresponding to a depressed or thinly-traded TAO price. With liquidity and confidence low, the token might experience abrupt dips. Holders remain reluctant to lock it up if they expect further declines or are unsure of future yields.

Slow subnet growth: Demand for on‐chain activity is subdued, and few new subnets or dApps are launching.

The market in ‘Meteor’...

Thin market signals: Because few tokens are staked, liquidity is shallow. On‐chain price discovery is easy to sway, so the dTAO formula often detects weak price momentum and results in volatility.

User incentives are insufficient: Subnets find it hard to attract capital, failing to secure enough TAO to issue meaningful Alpha, stalling growth plans and leaving new products stuck in test phases. Low subnet investment keeps staking yields low, which further discourages new stakers, perpetuating a cycle of limited participation.

The ‘Meteor’ ecosystem looks like…

Subnet Owners: Cautious about building on the network due to low TAO emissions or low user/validator base. They may delay or scale back dApp deployments.

TAO Holders: A portion might hold passively, waiting for signs of a turnaround. Others sell if they see no near‐term catalyst for growth.

Miners/Validators: Operation remains financially marginal. Some smaller validators either exit or consolidate—which could harm root network security still further.

The outcome?

When both staking and subnet growth are stubbornly low - as they are in ‘Meteor’ - the low-confidence, low-investment state can be hard to break:

Few tokens locked → minimal on‐chain liquidity → more potential for price swings → demand remains low → few tokens locked

Subnet owners see little traction, and therefore little reason to take risks and invest; but without a dynamic, growing subnet marketplace, TAO holders don’t stake for Alpha in sufficient numbers to stimulate growth. The system risks stagnation if no ‘spark’ occurs.

On the plus side, overall inflation for existing holders is low, as dTAO throttles emissions in an inactive market. But without a significant external event (e.g. new partnership or macro crypto bull run) injects demand, the ecosystem remains in a low‐activity rut.

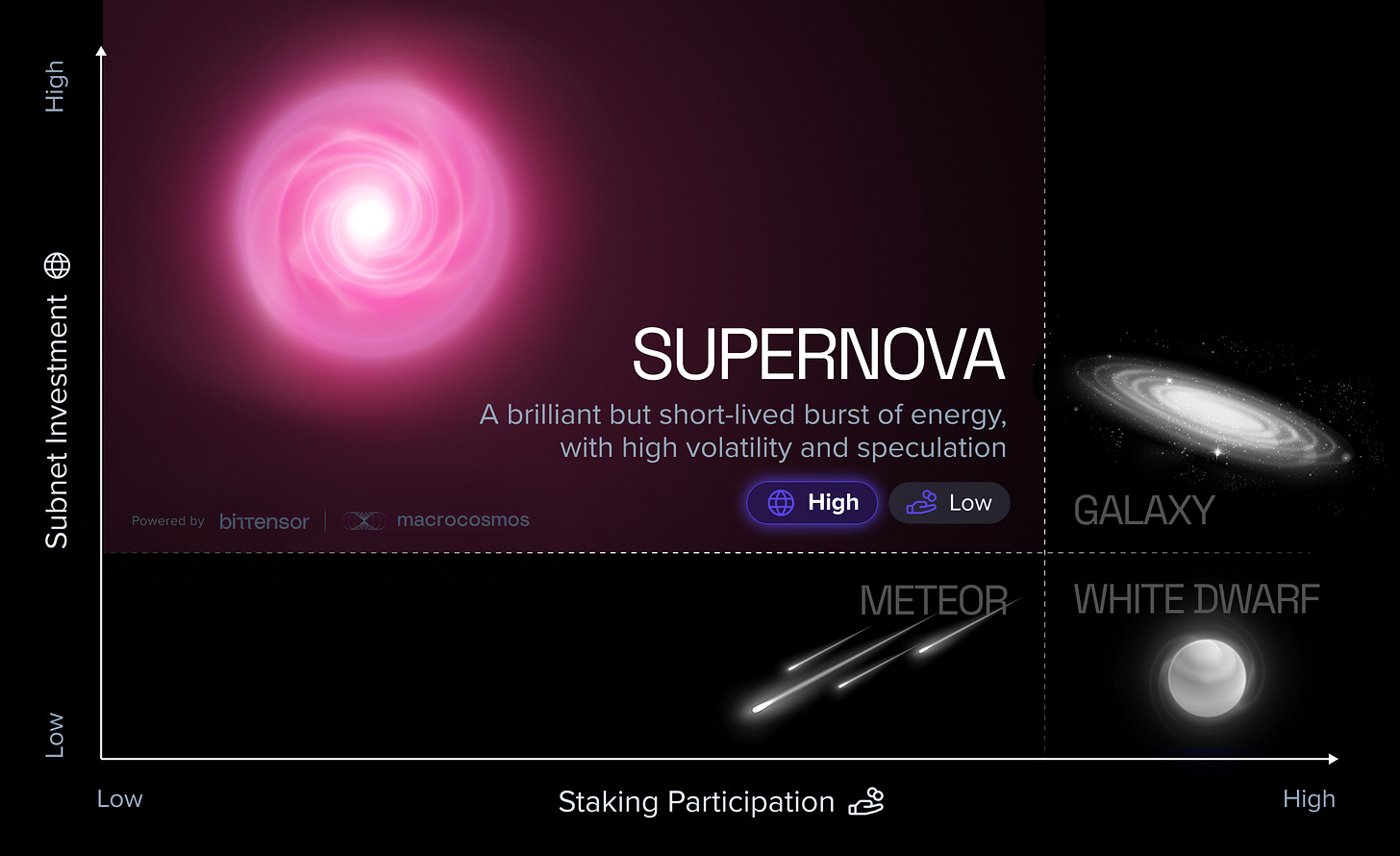

2. Supernova [Low Staking – High Subnet Growth]

A brilliant but short-lived burst of energy, mirroring high volatility and speculation.

Growth is good - but if dTAO boosts subnet growth without a corresponding increase in staking, the ecosystem might find itself in an unstable state.

The ‘Supernova’ state happens when…

Staking is low, but volatility is high: Coinciding with a hype cycle that spikes the TAO price, many tokens remain unstaked by short-term holders hoping for quick profit, and vulnerable to large trades can swing the price wildly. Promising subnets might attract speculators, raising the risk of corrections or crashes, which reduce trust and stability for users and subnet owners alike.

Rising (but unequal) subnet usage: Fuelled by high TAO prices, the network enjoys a surge of new subnets or dApps—investment driven by price hype, a killer app, or improved marketing. Yet because most capital is staying liquid in open markets for speculation rather than locked in either root or subnets, the subnet landscape stratifies. Those that do manage to attract capital could see large, short bursts of staking to farm high Alpha yields—then abrupt exits if the price (or the subnet’s hype) fades.

The market in ‘Supernova’:

Volatile Prices: With not enough tokens staked, the liquidity pool is relatively shallow; large trades can cause big swings. This volatility can prompt dTAO to oscillate emissions (mint more during price spikes, slow down after dips).

Stake vs. Spend Tension: Subnet growth attracts more transactions, but many potential stakers prefer to use tokens in dApps or keep them liquid to speculate on the rising price.

The ‘Supernova’ ecosystem looks like…

Subnet Owners: Those with the best marketing or novel dApps can tap into the hype, quickly attracting capital. Others might be drowned out.

TAO Holders: Torn between staking to capture a portion of emission rewards and staying liquid for short‐term trading gains. Whale manipulation can be more common in thin liquidity.

Miners/Validators: Potentially decent block rewards when the token price surges, but must handle the risk of big downward corrections if hype cools - the system lacks stable long‐term security.

The outcome?

‘Supernova’ drives rapid adoption, which could lead to greater brand recognition for Bittensor and increased inflows of external capital. This could lead to a virtuous cycle, eventually leading to a more steady-state balance of staking and subnet growth.

For some participants, however, the ‘Supernova’ scenario is an opportunity to benefit from short‐term speculation. The resultant price instability could spook less risk‐tolerant users and hamper long‐term trust in the network.

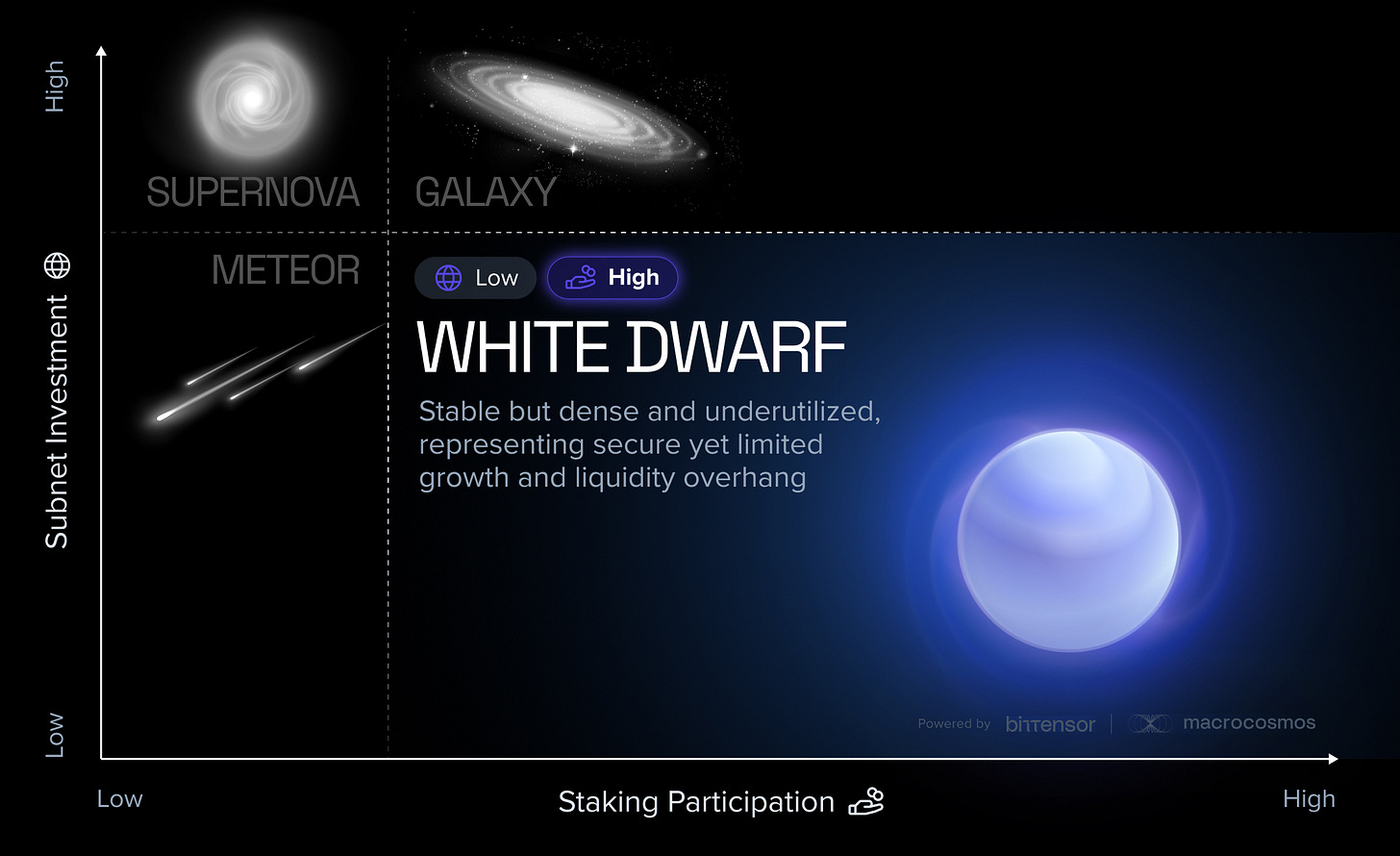

3. White Dwarf [High Staking – Low Subnet Growth]

Stable but dense and underutilized, growth is secure yet limited by liquidity overhang.

If staking and subnet growth decouple, it might be that staked TAO fails to drive investment in subnets - leading to a stalemate state of healthy yields but little else.

The ‘White Dwarf’ scenario happens when…

Robust root staking: A large share of TAO holders are attracted to staking, but prefer the stable yields of root rather than subnet-specific staking, locking up tokens and starving subnets of capital.

Minimal subnet activity: Despite a strong on‐chain security base, subnets are overshadowed by the root chain’s simpler or more certain yields, struggling to bootstrap their Alpha tokens at scale - leading to fewer new subnets or dApps.

The market in ‘White Dwarf’

Stable Market Signals: Because so many tokens are staked, the liquidity pool is deeper, making on‐chain price less volatile. dTAO sees limited upward price pressure—leading to modest or even fairly low emissions, since real demand for TAO utility is lacking.

Opportunity Cost: The yield is decent for stakers, but the ecosystem’s usage is underwhelming, leaving little impetus to expand beyond yield farming.

The ‘White Dwarf’ ecosystem looks like…

Subnet Owners: Frustrated by the difficulty of attracting stakers away from the root. They might need to propose higher yields or distinctive functionality to pull TAO over to subnets.

TAO Holders: Satisfied with relatively predictable staking returns. This can become a ‘comfort zone,’ where holders accept limited upside growth in the hope that subnets will attract them with better offers - but if this does not materialize, they might prefer to sell their TAO and invest elsewhere, especially if rival protocols appear.

Miners/Validators: Earning consistent rewards from a stable token supply. However, they may worry about the long‐term viability if subnet and dApp growth remains low.

The outcome?

The chain’s security can remain quite strong. The token price might be somewhat steady (though not necessarily high), reflecting a secure but underutilized network. Predictable yields come at the expense of on‐chain innovation, especially if developers don’t see strong user engagement.

However, slow ecosystem growth might eventually erode the attractiveness (and yield) of staking. If no killer dApps appear, the chain risks stagnation in spite of its staking metrics.

4. Galaxy [High Staking – High Subnet Growth]

A dynamic, interconnected constellation of energy and thriving activity: a harmonious, booming ecosystem.

High subnet growth, high staking participation: what happens if dTAO drives Bittensor’s market into a prolonged boom?

The ‘Galaxy’ scenario happens when…

Strong Subnet Proliferation: Multiple new dApps/subnets launch successfully, fuelling broader user adoption. If hype gets too strong, mini‐bubbles can form, but the large staker base and active subnets provide a stabilizing feedback.

Broad Staking Commitment: In an ideal ‘boom’ scenario, we might see a balanced split: enough TAO is staked in the root for security, while subnets also attract sufficient stake to issue meaningful Alpha, creating a positive feedback loop.

The market in ‘Galaxy’:

Resilient Price & Healthy Emissions: Real demand (subnet usage) supports the token price, while deep staking reduces extreme price swings. dTAO can sustain a moderate to somewhat elevated emission schedule that fosters further growth.

Positive Feedback Loop: Developers see a stable, high‐adoption chain, which draws in more projects; stakers see good yields and price appreciation, encouraging them to keep locking TAO.

The ‘Galaxy’ ecosystem:

Subnet Owners: Enthusiastic about the stable, large user base and the synergy from dTAO’s well‐funded incentives. They can propose new features or tokens, knowing they can attract stakers from a large, confident TAO community.

TAO Holders: Satisfied stakers who earn yields from either root staking or subnets (or some combination). The steady price or uptrend encourages more to lock up their tokens, while more subnet growth means a wide variety of innovative, well-funded projects to choose from.

Miners/Validators: Enjoy robust block rewards, especially if the token price remains strong. Competition among validators can increase, driving up the chain’s security and possibly lowering stake returns over time, but this is offset by ecosystem growth.

The outcome?

Galaxy shows what’s possible if the Bittensor were to integrate a positive feedback loop:

Robust root chain → user confidence → more subnets → more stakers who want Alpha → more healthy demand for TAO → sustained price.

Network matures quickly with broad confidence among users, builders, and validators. dTAO can sustain moderate or higher emissions to reward the ongoing growth cycle. And subnet owners are encouraged to invest more, leading to faster network maturity. All of which would fuel rapid expansion, strong user confidence, and a vibrant developer community.

Of course, no system is perfect. ‘Galaxy’ could create ‘growing pains’, especially around scaling challenges and governance. Managing success can be tricky: if emission or adoption grows too quickly, the chain might face scaling challenges, governance issues, or mismatch between network capacity and usage.

Even so, its dynamic, healthy, interconnected ecosystem remains the ideal trajectory for long‐term success.

So which future will it be?

These scenarios are only one way of framing the different futures that dTAO could usher in. They’re by no means exhaustive - and in focusing on the interplay between subnet growth and staking participation, they inevitably marginalise other external factors (such as crypto market regulation or the appearance of competitor ecosystems) that might affect Bittensor’s trajectory.

Nonetheless, studying these four scenarios helps the community plan ahead, monitor early indicators (e.g., staking ratio, new subnet announcements), and prepare potential responses (e.g., adjusting dTAO parameters) to steer the ecosystem toward better outcomes for all. For example, price and root‐vs‐subnet staking are major drivers, project teams and community members might want to track:

Circulating TAO vs. Staked TAO (root) vs. Staked TAO (aggregate subnets)

It’s also important to remember that, rather than any single state dominating, the ecosystem can (and probably will) transition from one to another in quick succession. Price volatility can cause movement between quadrants more suddenly than a stable‐price scenario. The system might lurch from a ‘Supernova’ of frenzied hype to ‘Comet’ of low growth if a large price crash occurs and stakers pivot quickly, or from ‘White Dwarf’ to ‘Galaxy’ if the price recovers strongly and triggers more confidence in building out subnets.

No one can predict the markers perfectly. While we at Macrocosmos have been carefully preparing for the different scenarios that dTAO could bring, we remain focused on our core mission: to build the best subnets on the network, integrate their functionality, and harness them to create impactful products that drive long-term value on Bittensor.

Either way, it’s going to be an unforgettable ride. Thanks for joining us.

Questions? Feedback? Ideas? We’re here for it - join our Discord andTelegram communities, debate the future of dTAO, and help move Bittensor forward.