dTAO is go: Here’s what you need to know

dTAO is set to launch mid-February - so what does it mean for staking, emissions, and the future of Bittensor?

After months of anticipation, dTAO is now about to launch. The latest version is running live on Bittensor testnet, the early indications are promising, and all signs are pointing to going live in February 2025.

While dTAO will bring big changes to the ecosystem, it’s actually a ‘doubling down’ on decentralization. By transitioning emission allocation away from a centralized voting system towards a free market economy, dTAO will unleash the full potential of competition and help ensure that the best subnets are properly rewarded.

Ahead of launch, here’s a guide to how dTAO affects key aspects of the Bittensor ecosystem.

Staking

Previously TAO was simply staked to validators with no subnet allocation. Validators acted as the trusted middlemen, estimating where best to invest their allocated TAO and offering competitive APR to token holders in return.

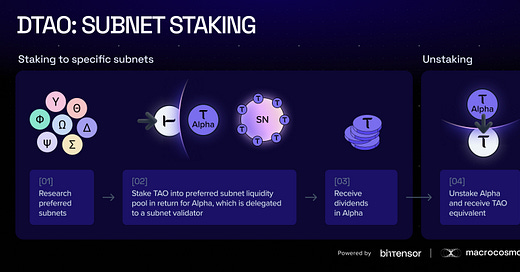

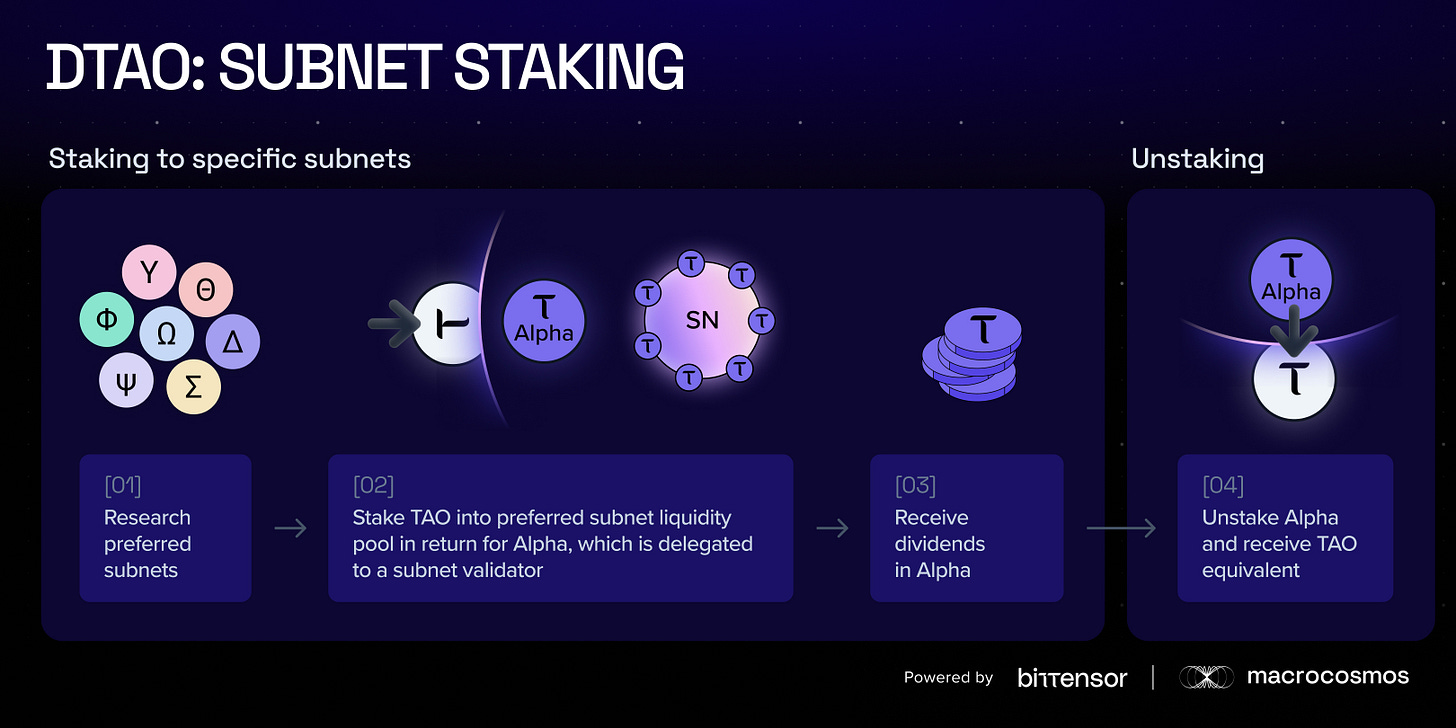

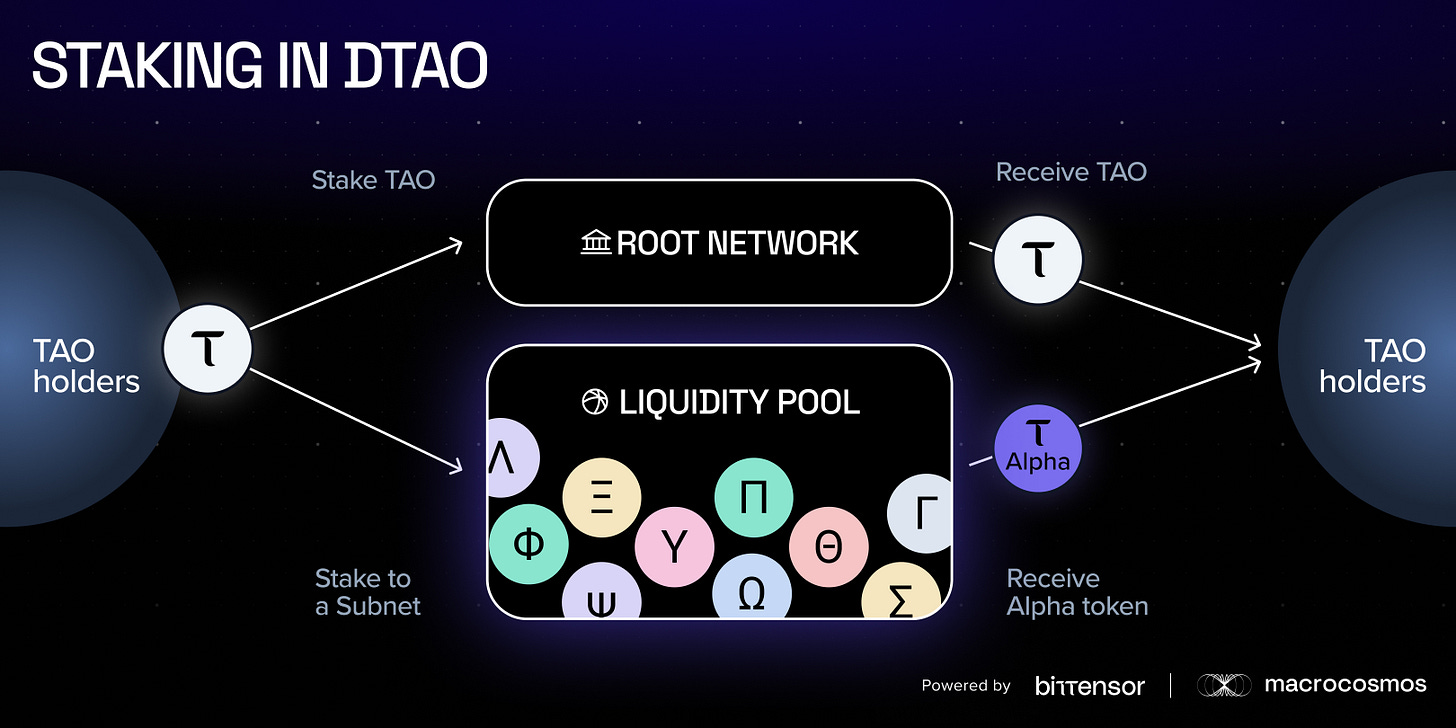

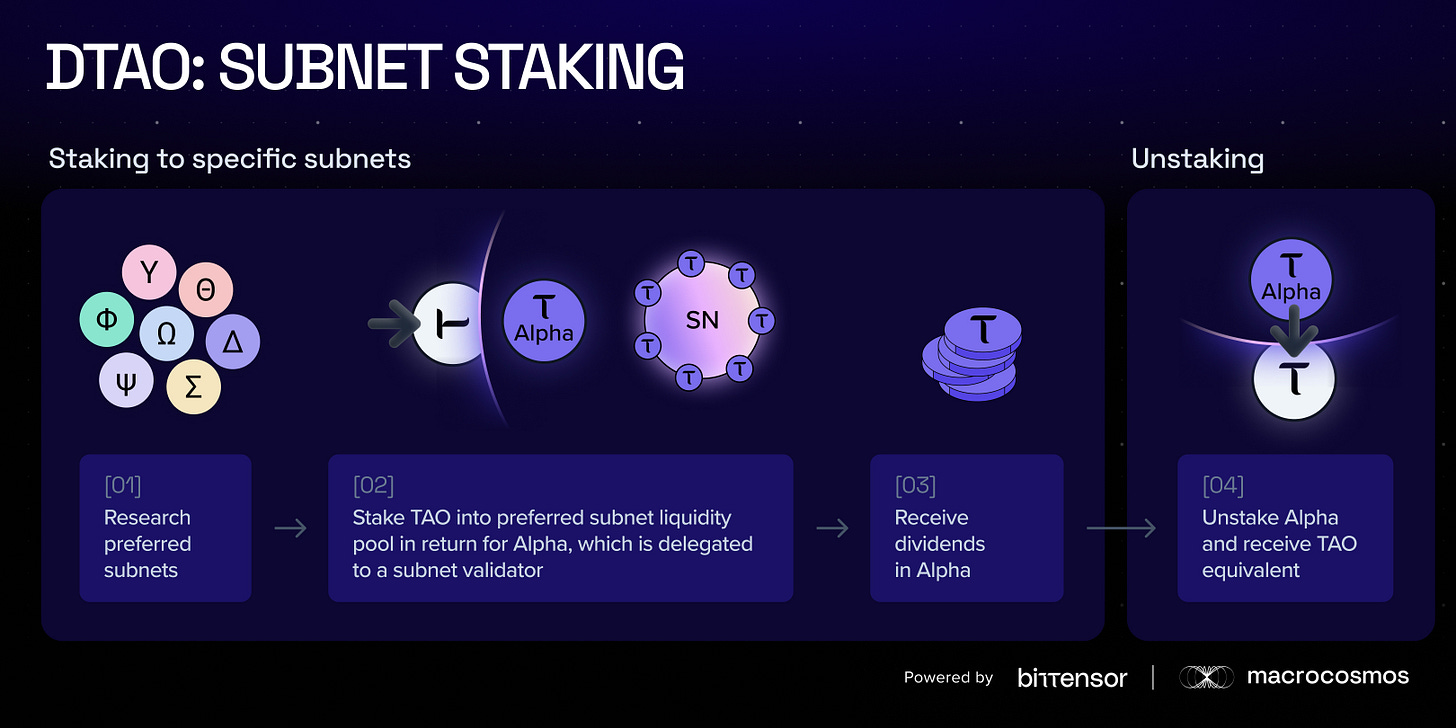

Now, stakers themselves will be able to choose. They can simply stake in TAO for a lower (but reliable) return, or stake to specific subnets for a variable outcome - where both capital and emissions are at risk.

For risk-averse or long-term backers of Bittensor, staking in TAO offers continuity with the legacy staking system. However, for TAO holders with strong confidence in particular projects or subnets, dTAO provides a way for them to back those projects and enjoy the spoils of that subnet’s success.

Nonetheless, subnet-specific staking significantly changes the risk profile. This is because staking into a subnet works like a liquidity pool, with the exchange rate between the newly-created subnet ‘alpha’ tokens and TAO rising or falling depending on participant activity. The value of subnet alpha tokens will depend on supply and demand in the liquidity pool - which means more volatility.

Emissions

Network emissions have been determined through a ‘vote’ held by a committee of validators, investors, and trusted Bittensor stakeholders. The root network acts as the foundation for all Bittensor’s subnets, by empowering highly invested entities to set weights and stimulating growth of the network’s most viable commodities.

This system was always intended as a placeholder, and is now being replaced by dTAO. Performance, reward, and value differ across subnets, and no matter how well-informed and well-intentioned, no committee can allocate emissions in a way that is truly accurate with its performance and potential.

dTAO ties the value of Bittensor’s commodity systems - its subnets - to supply and demand. Before, the commodity representing these variables (TAO) was the same across all the subnets. dTAO shifts to a market-based weighted average of TAO staked into the individual subnet liquidity pools, so that each subnet is exposed to free market conditions. This should ensure more competition, and ultimately better performance.

For subnet owners, the onus is on them to give TAO holders an economic incentive to stake to their subnets, rather than just convince validators to grant them emissions. For the ecosystem, it should mean more choice, better products, and ultimately faster progress.

Launch

While no firm date has been set, dTAO is expected mid-February, with the upgrade launching on the week beginning February 10th. Following dTAO’s successful debut on testnet, exact timing depends on the Opentensor Foundation’s approval by vote of the revised BIT001, which outlines the proposed technical changes.

TAO holders don’t need to do anything on launch day. Price volatility is likely - but price volatility has always been synonymous with blockchain-based tokens. Understanding how dTAO works is nonetheless important, especially for those with particular interest in or exposure to specific subnets.

For subnet owners and validators, preparation is key. dTAO will launch with very low liquidity (i.e. very small numbers of TAO and ‘alpha’ in the subnet liquidity pools). This could lead to substantial slippage shortly after launch. Simulations of dTAO indicate that liquidity will steadily increase, equalising over the first few months.

Amid the uncertainty, there’s a lot of excitement. All signs point to a successful launch, but much will depend upon the broader readiness of both the ecosystem’s infrastructure (for example, Taostats’s explorer migrating to display dTAO) and the community itself.

The future

dTAO intensifies Bittensor’s competitiveness - but its impact will be heightened by another upgrade, that brings Ethereum Virtual Machine (EVM) capabilities to the network. EVM compatibility will allow smart contract functionality, enabling on-chain applications. In turn, this will expand the range of products, services, and functionalities of our ecosystem. More people will be able to build, promote, and exchange a greater variety of assets and services, and be properly rewarded for it. That should enable Bittensor to grow faster, without compromising on what the ecosystem does best.

Bittensor is buckling up for what could be a bumpy ride. But dTAO will be worth it. Not only does it eliminate a long-standing centralized component in what’s supposed to be a decentralized system, but it also unlocks a greater range of capabilities on Bittensor - strengthening the network’s position amid competing DeAI platforms, and ensuring its long-term future.

Stay tuned for more dTAO guides, commentary, and analysis ahead of and after launch - join our Discord server for the latest updates.