dTAO: How to define value on Bittensor - and drive it

Our CFO, Michael Bunting, explores the nature of value through financial principles, identifying how best to define and deliver it on our ecosystem.

The introduction of dTAO is an important moment for Bittensor. For the first time, TAO holders rather than validators will be responsible for determining recipients of TAO emission in the network. In the process, they will also be exposed to a new system of risk and reward in holding ‘subnet tokens’.

Amid the uncertainty, applying basic financial valuation principles can help make sense of this new world. As well as providing a comparative frame of reference, financial analysis can also support and guide the network’s future capital allocation to support longer term value creation - for the Bittensor network and TAO holders alike.

What is value?

At its core, Bittensor is a system for validating information and commoditising it through subnets. Understanding value at a deeper level can help to reveal the underlying dynamics influencing commodity creation in the ecosystem.

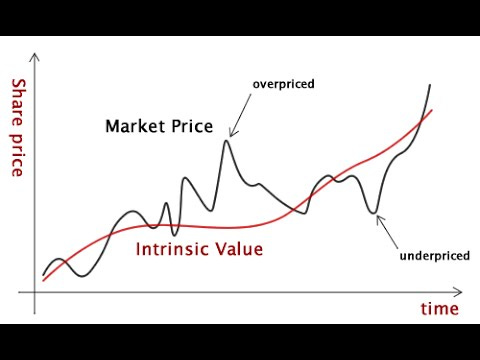

There are two schools of valuation methodology: market value and intrinsic value. In most cases, they provide estimates rather than precise scientific outcomes - and usually, it helps to consider both when attempting to value something.

Assessing market value means considering what similar assets have sold for recently and how the target asset compares to them. Market value can be fickle, and is subject to ups and downs unrelated to the target asset; it can be as simple as going out of fashion.

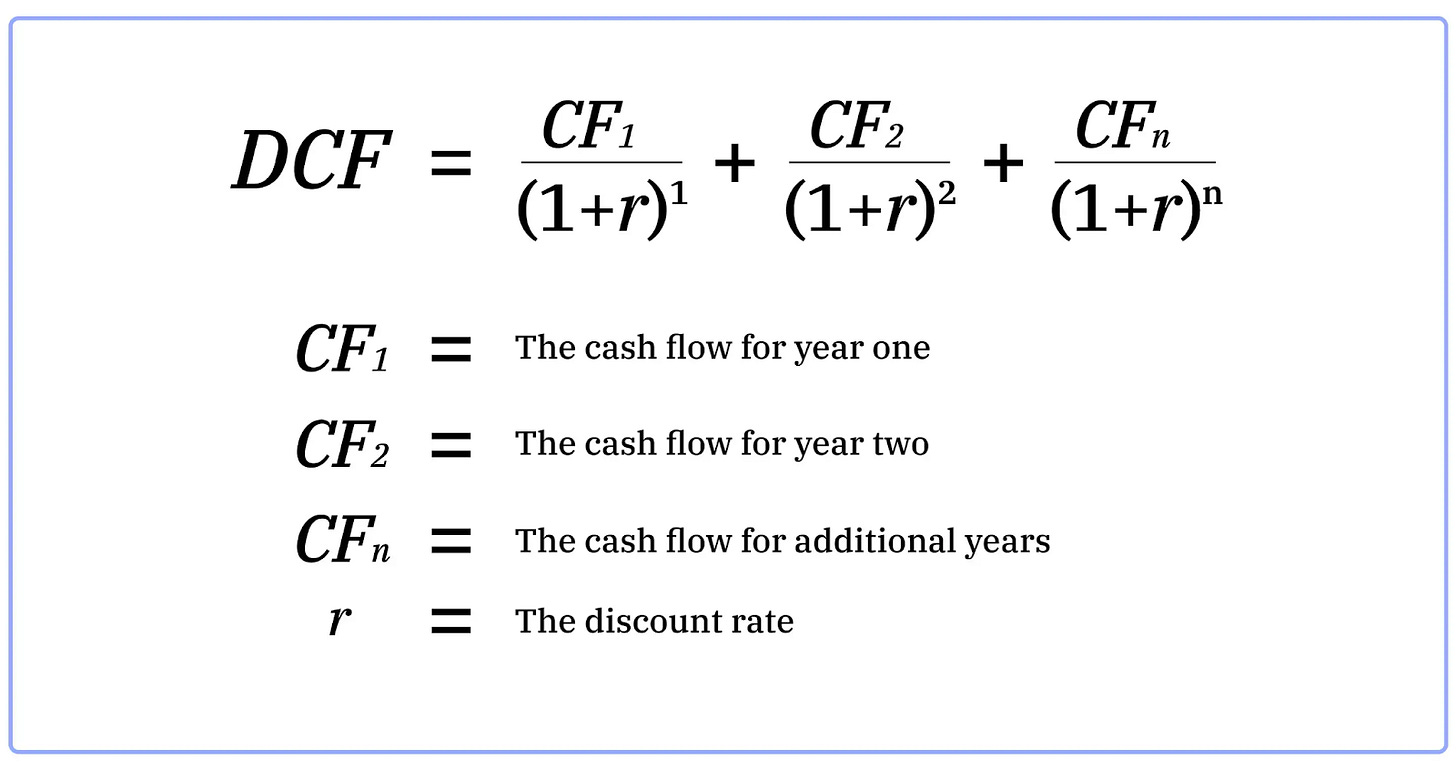

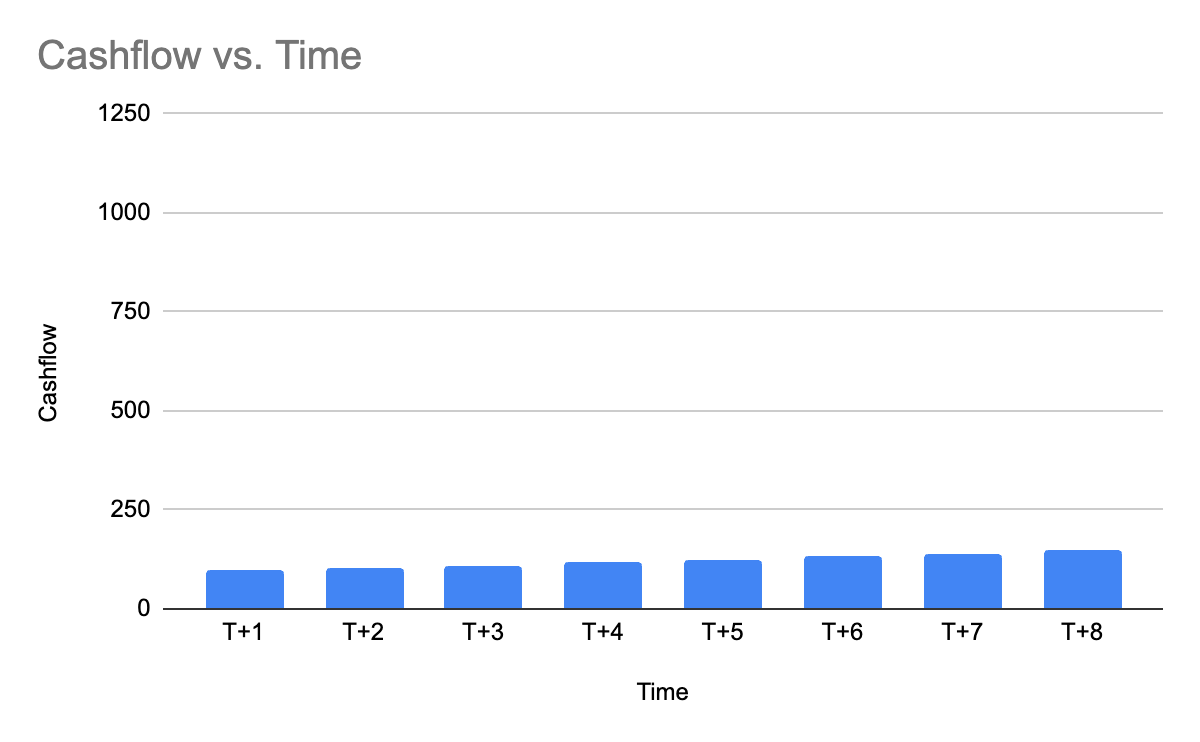

Intrinsic value is more fundamental to the asset in question. It’s the sum of all future value that will accrue to the owner of the asset as a result of owning it, with a discount applied reflecting how long the owner has to wait to receive it. This obviously must be net of any costs required to realise that value. In financial valuation, we usually use a discounted cash flow calculation to represent this.

Using the simple example of a house, a market valuation would reflect what similar houses in the local area have sold for recently. An intrinsic valuation would be calculated as the discounted cash flow that could be realised in the future by letting the house to a tenant (net of the ongoing costs of maintaining the property, etc).

In a relatively straightforward market like real estate, these values are usually similar and, generally, over time market value should track intrinsic value. How closely they track depends on prevailing macroeconomic conditions, liquidity, availability of information (market efficiency) and a host of other factors.

Sometimes, when economic conditions allow, value estimates can rise very quickly. This can give rise to speculative investment which either (i) uses overly optimistic forecasts for future growth in cashflow, (ii) is purely based on a ‘greater fool’ theory that market prices will continue to rise, allowing the speculator to sell at a higher price than they buy, or both. Often the high prices will collapse quickly a short time later as forecasts are proved to be overly ambitious, or the market runs out of buyers.

How does this apply to Bittensor and TAO?

Crypto-sceptics often say these digital assets have no value because they generate no cash flow. In some cases that’s true, but that is by no means always the case; often, you have to delve deeper to see where the value lies.

TAO should create cash flow in the future because validators can sell their bandwidth to use the Bittensor network and its suite of subnet products. They’ll incur costs in doing so, but if the products within are competitive in the AI marketplace, they’ll be profitable. In an equilibrium future state, validators will have to compete for TAO stake by offering a return to staking TAO holders (for example, by returning some of their revenue profitability). TAO holders will realise future cash flow from this return - therefore, there is a future cash flow associated with TAO.

Today, this is largely speculative. TAO’s valuation rests on the perception of what this future cash flow may be, and speculative investment from a wide range of professional investors and crypto enthusiasts.

dTAO allows us to make the same assessment, but for specific subnets (rather than Bittensor as a whole), by introducing a market-driven mechanism for pricing a subnet. This gives us an immediate reading on a subnet’s market value. But what of its intrinsic value? dTAO makes the question of measuring valuable contributions even more pressing: how do we decide what subnets to support and increase the value of the Bittensor network and TAO?

Driving value in Bittensor and dTAO

In the Bittensor ecosystem, there’s some concern around whether dTAO will force subnets to shift towards prioritising short term cashflow over long-term goals. The risk is real, but there are signs Bitternsor’s community won’t suddenly shift towards favouring (and buying pressure directed towards) subnets that prioritize the immediate gratification of short-term revenue generation.

TAO’s value relies on the delivery of a very large future cashflow prize. This is why ‘research subnets’ support TAO’s value proposition. If OpenAI announced it would no longer be improving its models, estimates of its value would quickly collapse - because the obvious conclusion to draw is that competitors would rapidly overtake its product, steal its customers and deprive the business of future cashflow. By pioneering innovations with future potential, research subnets play a similar role to the assessment of Bittensor’s long-term cashflow delivery.

That doesn’t mean that any research is good research, or any ‘long term’ subnet is a good subnet. Bittensor is not an academic project per se. Absent short term cashflow, there must still be justification for existence demonstrated by progress towards an obvious value-generative future goal. Research subnets should be able to articulate a vision for where they’re going and how their product will compete in the broader AI marketplace.

dTAO is going to shift the responsibility for setting emissions from an existing group of well-known validators to the TAO-holder market-as-a-whole. Large TAO holders are motivated to support the TAO price. Therefore they should be motivated to support the long term success and broader perception of Bittensor by supporting subnets that will create long term value.

What should we be supporting to drive maximum value for Bittensor and TAO in the future? For subnet owners, the takeaways here are clear. It’s imperative to develop a vision for subnets that looks beyond Bittensor and points clearly towards a real economic opportunity. Subnets generating cash already will quickly find a place in dTAO and will thus support the value of TAO. Research subnets need a business plan that gets to value creation and profitability; those that can’t do this will suffer in dTAO, and rightly so – no start-up without a vision for how to compete and win in its market has a right to survive.

We should be supporting qualities which either increase the size of our assessed future cashflow expectations, or (ii) reduce the uncertainty associated with them.

In assessing value across Bittensor’s subnets, we should generally examine the following areas:

Market

Products with a unique approach, niche, or technological edge that they can describe, prove, and realistically pursue will have a much greater chance of long-term success. Subnets offering resource provision (e.g. compute) need to articulate an edge that will allow them to overcome economies of scale that competitors already possess.

Product

Development and performance shouldn’t be assessed solely with a Bittensor lens - there must be comparison to competing products (centralised or otherwise) across the whole of the relevant market.

Products should be designed to be useful - e.g. incentivising the ‘least wrong’ outcome will not be sufficient if that does not lead to a ‘right’ (i.e. useful) outcome (especially if competing products exist which can be ‘right’).

In its early stages, the product must, as a minimum, push towards being functional and observable enough to make an initial assessment of viability.

Route to market

Subnet teams should be able to articulate who their current or future customer base is, and how they intend to engage with them (even if this is speculative).

For B2B products, it’s clear in most cases a reputable company of substance will need to exist and sign a contract in order to gain the trust of customers for success at scale. While an online ‘front end’ alone may be enough to convince smaller players to experiment with a cheaper product, larger customers won’t gamble on a product with no substantive support or recourse available.

For B2C products, a plan to invest heavily in marketing support, an ability to drive awareness and build a consumer brand and engagement will be essential - and evidenced by a viable roadmap.

Company & team

Beyond being merely identifiable and ‘contractable’, pedigree, accomplishments, and proven commitment to the success of their venture helps improve confidence in the likely realisation of future benefits and cashflow to TAO holders

Rather than just asking ‘Does the team have sufficient technical talent to create this product?’, we should encourage a broader focus on the business as a whole: ‘Does the team have sufficient breadth and depth of technical and non-technical expertise to create a profitable business model?’

What next?

Bittensor is effectively evolving into an incubator funding vehicle for tech start ups which are philosophically aligned with its founding principles. This is a positive step, but we must act professionally to support its long-term growth and eventual shift to broad adoption. Encouragingly, the validator community is recognising the change and shifting their focus to address these requirements. A new breed of Bittensor ‘fund managers’ or ‘allocators’ could potentially emerge to alleviate large TAO holders of their staking responsibility. If so, it should accelerate this transition rather than change its direction.

Ultimately, ambitious start-ups and innovative technology often take many years to build. The same is likely to be true for Bittensor and its ecosystem. Moreover, it’s better to build something genuinely great, with real long-term impact, than to focus narrowly on TAO’s market price fluctuations and encourage short-term - and short-sighted - growth. TAO holders now have the chance to support great teams building awesome products - if we can stick to these principles and objectives, the TAO price will follow.

Correctly incentivised, Bittensor can become one of the breakout technologies that will bring blockchain tech to mass adoption. Yet achieving this will depend on how well our ecosystem recognises and nurtures value.

Join our Discord andTelegram communities, debate the future of dTAO, and help move Bittensor forward.

Gracias ¡ Por la explicación 🙏